How social media moves markets: Analyzing GameStop (GME) using social listening data

Written by Jason Rechel

Published on January 28, 2021

Reading time 6 minutes

After five years of downward movement, GameStop (GME) shares skyrocketed this week—going from a closing price of $4.28 per share on January 27, 2020 to $345 on January 27, 2021, one year later. This morning, shares reached $490 in pre-market trading.

So what sparked this more than 7,200% increase in GME—and a 689% run just this past week?

In a word, Reddit. What started with a thread on r/WallStreetBets, a community where more than 3.1 million subscribers discuss aggressive trading strategies, drove such a significant increase that trading of GME was halted several times. President and CEO of Nasdaq, Adena Friedman, stated on Wednesday that the exchange would potentially halt the stock if it detected unusual trading activity that matched conversations on social media.

"We definitely have seen a significant increase in retail participation in the market throughout the year," says @adenatfriedman. "We do have technology that evaluates social media chatter…and match that up against unusual trading activity–we will potentially halt that stock." pic.twitter.com/UWvg53YFI6

— Squawk Box (@SquawkCNBC) January 27, 2021

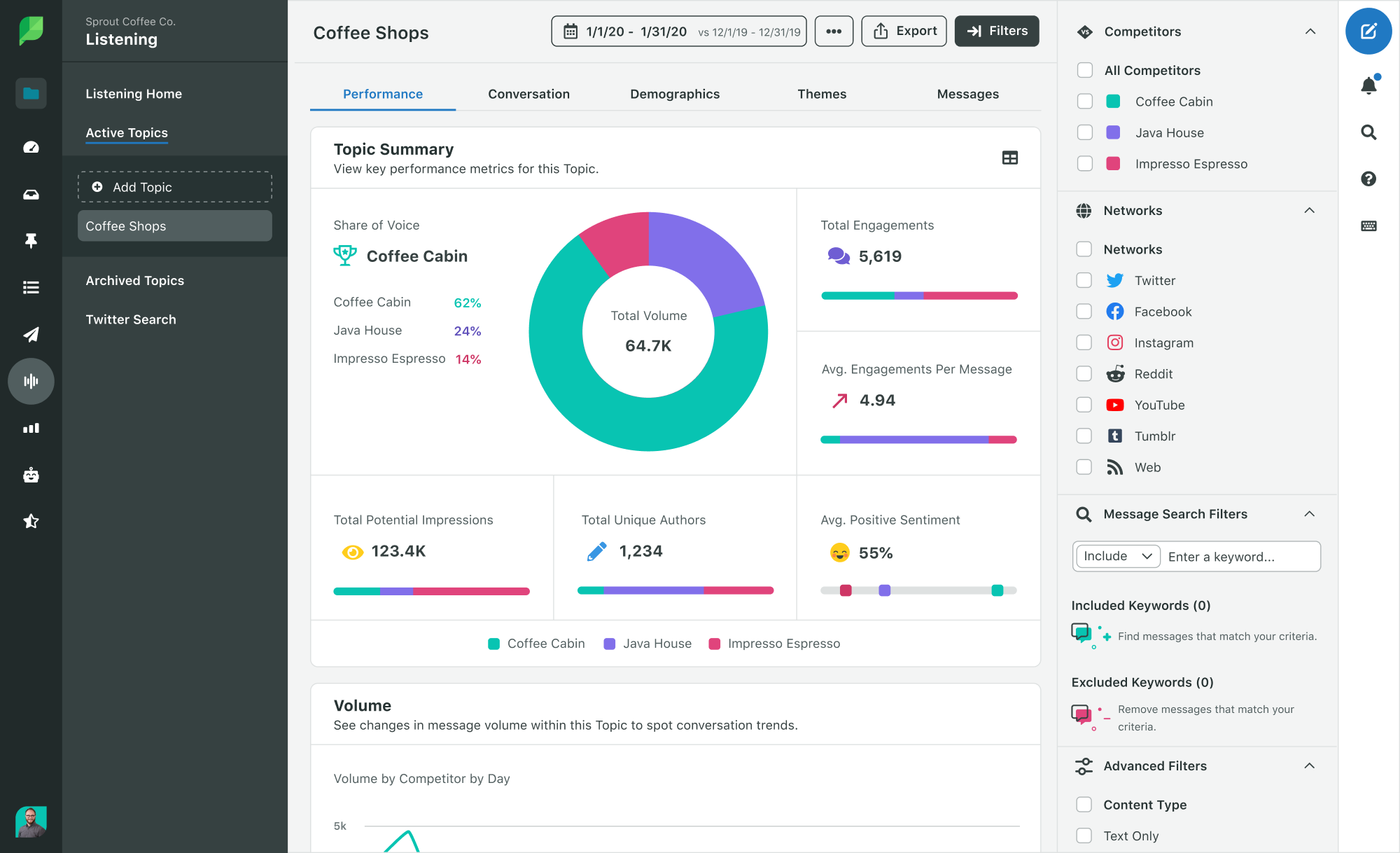

But while the conversation began on Reddit, it didn’t stay there for long. Using Sprout Social’s Advanced Listening, we tracked the rise of conversation about GME on social over the past week and analyzed it alongside price fluctuations in the stock to identify themes in the social chatter.

Read on to understand how social media influenced this extreme volatility and how social listening can help financial institutions and corporate issuers gain visibility into real time analysis.

Tracking the trend: How the GameStop run unfolded

As reported by Alex Kirshner at Slate, a Reddit user in the r/WallStreetBets community published a post in September 2020 with the title, “Bankrupting Institutional Investors for Dummies, ft. GameStop.” Kirshner writes:

The subredditor noted the stock already had a significant short exposure (months before Cohen joined the board) and predicted that short sellers would be forced to abandon their positions and, in buying back their stock, drive the price up. R/WallStreetBets users delighted in the idea and took it as a chance to egg one another on.

This post would mark a nearly 20-year bottoming process in shares of GME, at this point still trading below $10. This week, shares rose above $372 and trading was halted multiple times.

Social conversation around GameStop and r/WallStreetBets began to heat up over the past week. From January 20 through January 27, there were more than 82,000 Reddit mentions of “GME” on Google, and Sprout Social Advanced Listening captured more than 1,582,000 Tweets and 1,465 YouTube videos about GameStop. During the same time period, the conversation on Twitter and YouTube alone had a potential reach of nearly 10 billion impressions, and in total, has generated nearly 12.8 million social engagements (likes, comments and shares).

To put that growth in context, comparing the conversation on Twitter and YouTube from January 20–27 to the prior week, we see a:

- 2,805% increase in topic volume

- 3,041% increase in potential reach

- 4,521% increase in social engagements

So how has social conversation volume correlated with price fluctuations of GME? Nearly perfectly. As chat volume across social channels spiked higher over the past week, so has the stock. The growing volume of engagement on social and social listening insight into the context of what was being said could have alerted market participants to pay closer attention.

Common topics in the Twitter and YouTube conversation about GameStop (GME) between January 20 and January 27, 2021 included:

- Reddit: Unsurprisingly, Reddit was one of the top keywords in the conversation, mentioned and hashtagged more than 128,425 times; “Reddit users” was mentioned more than 70,800 times. The hashtags #WallStreetBets and #WSB, both referring to the community where the GME conversation started, were used 30,944 and 18,871 times respectively. Overall, Twitter and YouTube conversations about GameStop using #WallStreetBets or #WSB grew 22,674% from January 20–27 compared to the week prior.

- Congress: On Twitter, Congress was mentioned more than 50,200 times as users speculated about how quickly Congress would pass new legislation regulating the stock and compared that to the delay in passing $2,000 stimulus checks.

- People: The word “people ” came up in more than 190,400 Tweets, as the story told in the media and on social focused on the power that retail investors can wield on a system that favors the rich. Many messages, including one from Gravity Payments CEO Dan Price, stated that the GME and related short squeezes happening now are simply real people doing what financial institutions have always done.

- Hedge funds: Mentioned more than 76,400 times, hedge funds were positioned as the Goliath to Reddit users’ David, and the conversation focused on hedge funds’ forced retreat following heavy losses. Many users in the thread have taken delight in the financial pain inflicted on hedge funds.

Other stocks caught the wave and began to see a similar uptick, including AMC Entertainment Holdings (AMC), Express (EXPR) and Bed Bath & Beyond (BBBY). Within the conversation about GameStop on Twitter between January 20–27, 2021:

- AMC was mentioned in more than 233,000 of the messages discussing GameStop, and the hashtag #SaveAMC was used in 4,834 messages.

- EXPR was mentioned in more than 12,280 of the messages discussing GameStop.

- BBBY was mentioned in more than 15,860 of the messages discussing GameStop.

As of this writing, GME shares opened at $265 on January 28, and we’re seeing more than 751,300 Twitter and YouTube mentions of GameStop so far this morning as the conversation continues.

What we can learn from GME and social listening

While a Bloomberg terminal, trailing financials and a precise understanding of business fundamentals can help forecast where a company is going, the volatility we’ve seen with GME, AMC and other stocks show that social media can disrupt market models in a moment.

If there was any question about whether social media could move markets, 2020 solidified the answer. Tweets from President Trump often drove fluctuations in the market, as tracked by Bloomberg before his ban from Twitter, and a Tweet from tech billionaire Elon Musk—the SEC’s Twitter persona non grata—drove the messaging app Signal to the No. 1 spot in Apple’s app store.

Use Signal

— Elon Musk (@elonmusk) January 7, 2021

But 2020 also demonstrated that the COVID-19 pandemic had very different effects on Wall Street vs. the average American consumer, as markets rose while unemployment disproportionately affected low-wage workers. This climate ignited the fire of social media communities like r/WallStreetBets, where posts about GME have fueled the narrative that hedge funds were the monetary losers on the wrong side of the trade.

There’s no greater source of real-time consumer conversations than social data. As social media communities mobilize to radically impact market behavior in ways not previously seen, there’s also a new source of market influence. Consumers can’t—and won’t—be ignored, and they’ve proven that social media is where they’ll mobilize. Couple that with the large social media followings of industry influencers like prominent VC, Chamath Palihapitiya, and you have a recipe for rapid market volatility.

Lots of $GME talk soooooo….

We bought Feb $115 calls on $GME this morning.

Let’s gooooooo!!!!!!!! https://t.co/XhOKL1fgKN pic.twitter.com/rbcB3Igl15

— Chamath Palihapitiya (@chamath) January 26, 2021

How to harness the power of social data

As we saw in Friedman’s statement earlier, companies like Nasdaq use social media conversations to understand and investigate trends in the market. Analysts who require the ability to forecast business financials with precision—and change that forecast on a dime as the world around them changes—can use social listening tools that offer an investment edge. This begins with competitive analysis, market trends and demand planning.

But in the midst of unprecedented volatility, advanced social listening has become a necessary tool to optimize the risk/reward calculation that sits at the center of most investment decisions on Wall Street. Knowing what is being said about companies on social media, before this is reflected in share price volatility, is essential to reducing portfolio risk.

For corporate issuers, executives and Board members, staying on top of social data is now table stakes in this new environment.

Advanced Social Listening can help do more than forecast. It can also enable users to:

- Track investor perception and sentiment to monitor risk and enable rapid adjustment to negative trends or reputational crises

- Understand consumer perception and perform due diligence outside of normal channels

- Offer insight into unique elements of a market that can help predict fundamental and stock price performance

- Monitor competitor news, movement and sentiment and know when to act

- Identify financial influencers and market movers to watch

If your company wants to bring comprehensive social intelligence into your forecasting toolkit, schedule a free, customized demo with one of our team members today.

Recommended for you

View all Recommended for you- Categories

6 Social media tips for banks and financial institutions

Published on April 16, 2020 Reading time 7 minutes - Categories

How social media drives cryptocurrency for users & brands

Published on September 4, 2018 Reading time 7 minutes

Share